The digital communication landscape continues to evolve as messaging apps become essential tools for staying connected. Whether for personal relationships or business communications, these platforms shape how billions of people interact globally. Here’s an in-depth look at the messaging apps that will dominate the market in 2025.

WhatsApp remains the undisputed champion of global messaging. With approximately 2 billion monthly active users, representing about one-quarter of the world’s population, WhatsApp’s reach far exceeds that of its competitors. The app delivers around 1 billion messages daily and maintains an impressive average of nearly 930 sessions per user monthly. Users spend an average of 16 hours per month on the platform, which is significantly more than on any other messaging service.

WeChat (Weixin in mainland China) ranks as the second most popular messaging app with 1.38 billion users, though the vast majority are concentrated in China. As both a messaging platform and an all-in-one super-app, WeChat offers a range of features, including payments, social media, and business services, that make it indispensable in the Chinese market.

Telegram has experienced remarkable growth, reaching 1 billion monthly active users in 2025. The platform’s emphasis on privacy through features like secret chats and self-destructing messages appeals to users seeking enhanced security. Available in over 190 countries and multiple languages, Telegram continues to gain traction, particularly in Eastern Europe and parts of Asia.

Facebook Messenger maintains its third position with approximately 1 billion monthly active users, though some regional variations exist. Interestingly, you don’t need a Facebook account to use Messenger—a phone number registration is sufficient. Despite its massive scale, the app shows moderate engagement compared to WhatsApp.

Rising Stars and Regional Leaders

Snapchat has carved out significant territory, particularly in Latin America, with over 900 million monthly active users. While its time-on-app metrics are lower than those of competitors’, Snapchat generates the highest revenue through in-app purchases, at approximately $24.77 million per month.

Discord emerged from gaming communities to become a versatile platform with over 200 million monthly users. Now used by gamers, businesses, educators, and communities, Discord’s text, voice, and video capabilities make it a comprehensive collaboration tool.

Regional leaders also deserve recognition. Line dominates in Japan and Thailand with exceptional user engagement. WeChat maintains overwhelming dominance in China. Telegram has become the preferred app in parts of Eastern Europe and Central Asia, including Belarus, Kazakhstan, Moldova, and Russia. Signal, known for its privacy-first approach, ranks first in the Netherlands and Sweden.

User Engagement Patterns

User engagement varies dramatically by geography and app choice. WhatsApp users in Argentina lead the global average with 1,502 monthly sessions, spending approximately 29 hours per month on the app. This reflects the app’s cultural significance in Latin America, where it has become the primary means of communication.

In contrast, European users demonstrate more moderate engagement. German and Dutch users average around 538 sessions per month, which is significantly lower than the global average. The United States shows interesting fragmentation, with no single messaging app achieving overwhelming dominance—WhatsApp, Messenger, iMessage, and Snapchat all maintain significant user bases.

Revenue and Monetization

While WhatsApp boasts the most extensive user base, it generates minimal revenue—a persistent challenge for Meta’s strategy. Snapchat leads in monetization, earning $24.77 million monthly from in-app purchases. Japan’s Line follows with $12.92 million, while Telegram rounds out the top earners at over $8 million monthly.

The Download Trend

Monthly download statistics reveal shifting preferences. Telegram leads with approximately 50 million monthly downloads, followed closely by Snapchat at 29.49 million. WhatsApp averages 57.35 million downloads monthly across all platforms, demonstrating sustained interest despite its massive existing user base.

Security and Privacy Considerations

Security has become increasingly important to users. WhatsApp, Facebook Messenger, and Telegram all offer end-to-end encryption for messages. However, differences exist in implementation. Signal remains the gold standard for privacy-focused communication, offering industry-leading encryption with minimal data collection.

Telegram’s secret chats feature and self-destructing messages appeal to users prioritizing privacy. Meanwhile, privacy advocates often raise concerns about WhatsApp cloud backups, which may not maintain the same encryption standards as regular messages.

Business Applications

Beyond personal use, messaging apps have become crucial business tools. Slack leads the workplace collaboration space with structured channel-based communication. Microsoft Teams, WhatsApp Business, and Telegram cater to the needs of enterprises, while Discord facilitates team coordination across the creative industries.

Global Preferences by Region

The Americas exhibit a strong preference for WhatsApp, with dominant usage in Brazil, Mexico, Canada, and the United States. Europe mirrors this trend, with additional strength for Signal in Northern European countries. Africa and Asia exhibit greater diversity—WhatsApp remains strong globally, but regional apps like Line, WeChat, Viber, and KakaoTalk maintain significant user bases.

The Future of Messaging

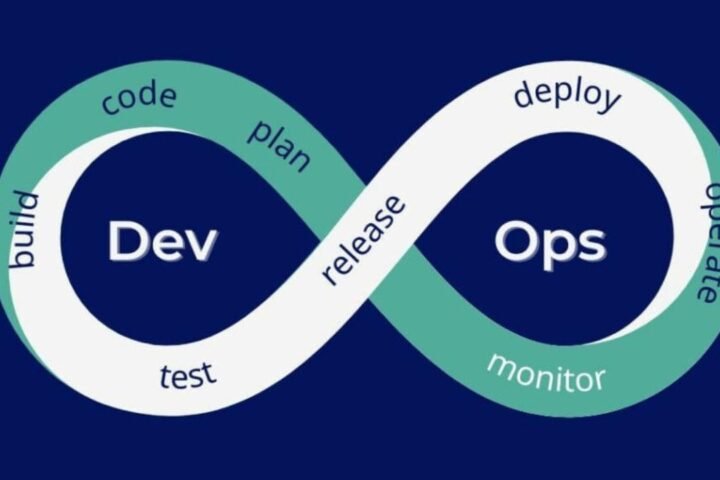

As 2025 progresses, several trends emerge. Interoperability between messaging platforms may become more critical as regulatory pressure increases. Privacy concerns continue driving users toward privacy-first alternatives. Business integration and professional communication needs push corporate adoption of specialized platforms.

The messaging landscape demonstrates that while global platforms like WhatsApp achieve unprecedented scale, regional and specialized apps thrive by serving specific cultural, linguistic, and professional needs. Rather than a winner-take-all scenario, the market supports multiple successful players addressing different user priorities and geographic preferences.

Conclusion

The messaging app market remains dynamic and fragmented by region. WhatsApp’s global dominance is undeniable, yet successful competitors thrive by emphasizing privacy, user engagement, community features, or regional relevance. Users are increasingly maintaining multiple messaging apps rather than consolidating on a single platform, choosing the right tool for different purposes and social circles. Whether prioritizing security, business functionality, or cultural relevance, today’s users have genuine alternatives—and that competition ultimately benefits everyone through continued innovation.